BAL RAKSHA,

BHAVISHYA RAKSHA!

For lasting change to happen, the hands of many must join as one.

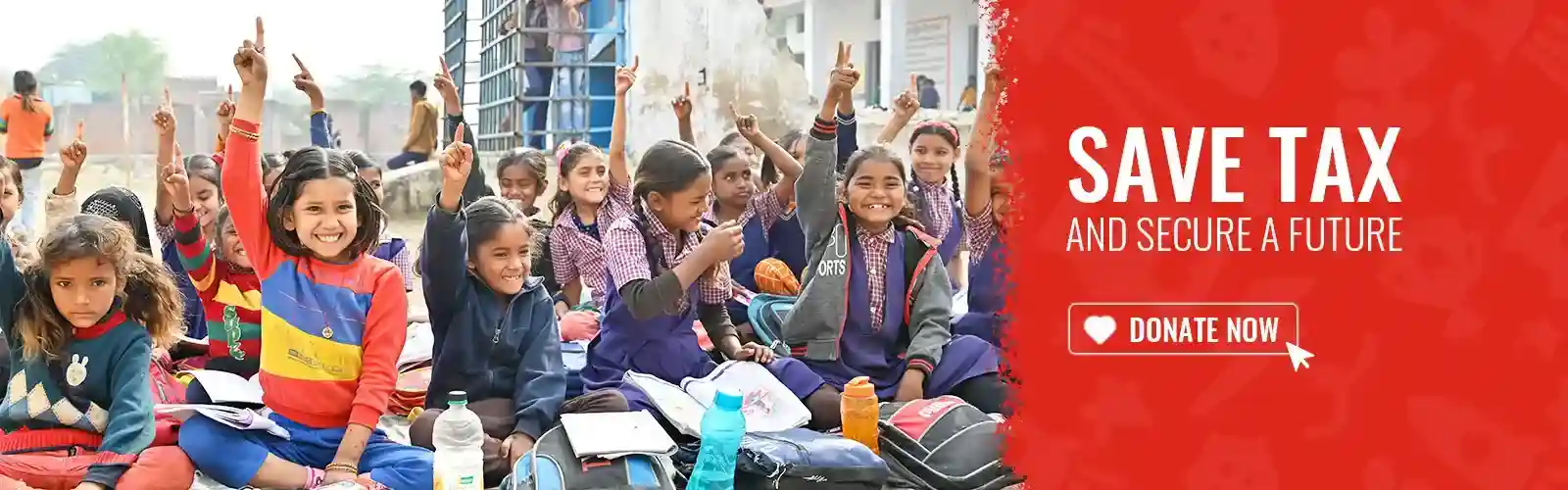

Since 2004, Bal Raksha Bharat NGO has collaborated with partners, supporters and agencies at various levels towards actualising the vision to build a new “Bharat”: one where children are given equal opportunities, access to healthcare, wholesome nutrition and protection from exploitation. We are on a mission to help children build a Secure Childhood and thus move to the path of building a Secure Future, for them, for the country. We believe in providing Holistic Care and Support to children, for when a childhood nurtured holistically, the child’s .

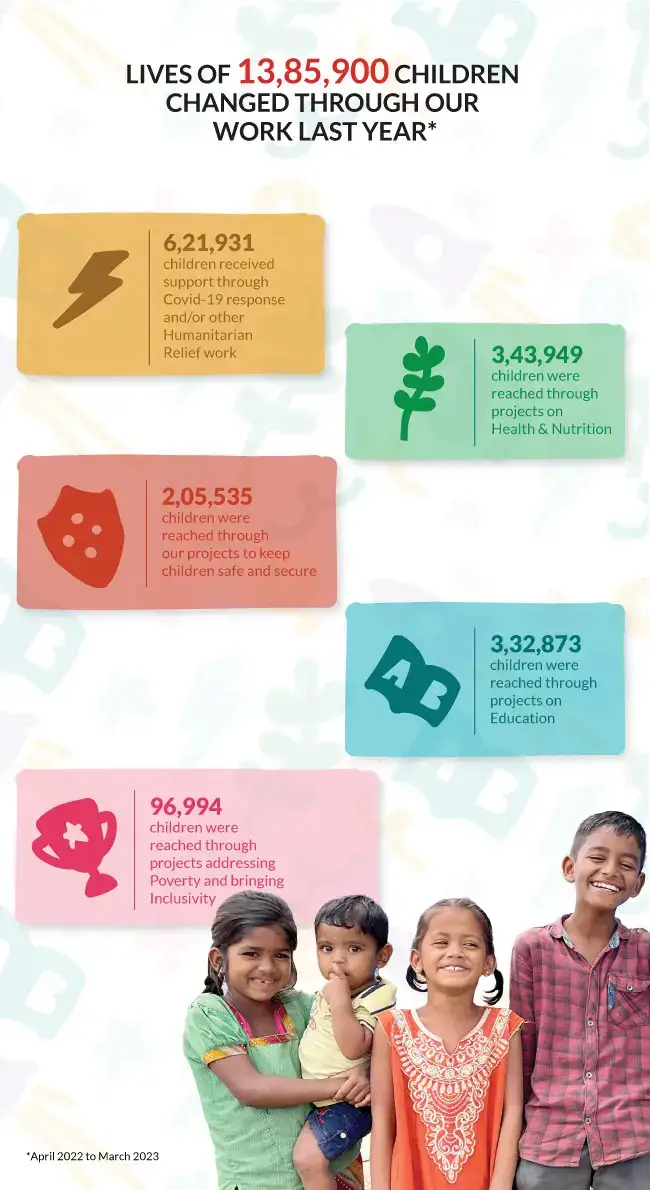

In the last 15 years, more than 1 crore children have benefitted from our work. Last year (April 2022 to March 2023), more than 13 lakh children were reached through our work in 15 states and 3 Union Territories. We are steadfast in our resolve to continue doing more for children and building a world where their childhood is safer, fairer, healthier and happier.

We appreciate all the support that we can get on our quest. Check out our programmes and choose how you would like to support towards helping shape a brighter future for the nation.

-

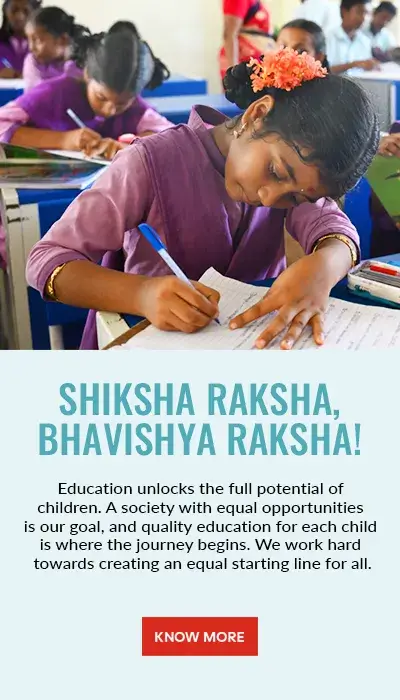

Education

-

Health

-

Nutrition

-

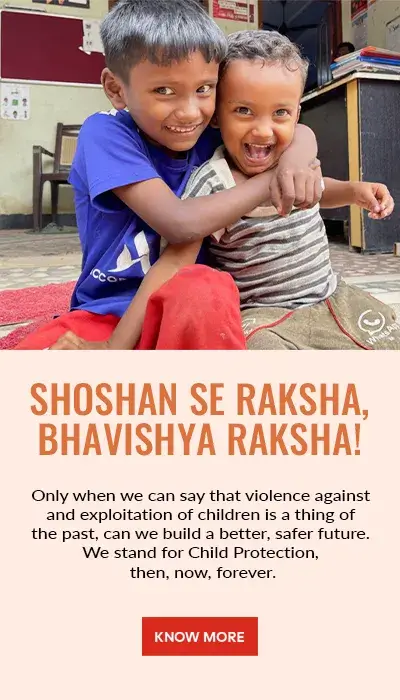

Protection

-

Inclusion

-

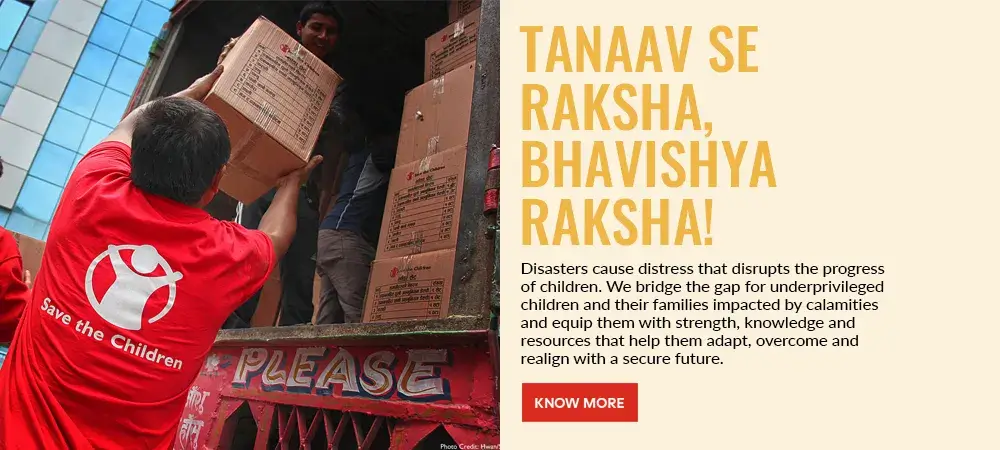

Resilience

Bal Raksha Bharat in collaboration with ‘I am for Alleppy’ banner and Kudumbashree (Kerala State Poverty Eradication Mission) undertook the following relief operations amongst more humanitarian work.

- 32,762 from 6,125 households were supported with hygiene, utensil, and shelter during the relief period

- 30 Anganwadi centers were rebuilt in Kuttanad area

- More than 4,000 children were provided with education kits

- Massive cleaning drives were undertaken in six-gram panchayats with the support of the community

Bal Raksha Bharat’s teams stocked up relief material like shelter kits, household kits and education support material for children and families hit by Cyclone Fani.

Additionally, during Assam and Bihar floods in 2019, we reached 15,000 children in Assam immediately with life-saving aid including temporary shelter, water, hygiene and sanitation services – all of which are essential to protect children from the elements

and potential disease.

We continue to provide humanitarian support to victims of Delhi Violence since February.

We are also consistently providing COVID relief to many children, families, and communities since the first lockdown in March 2020.

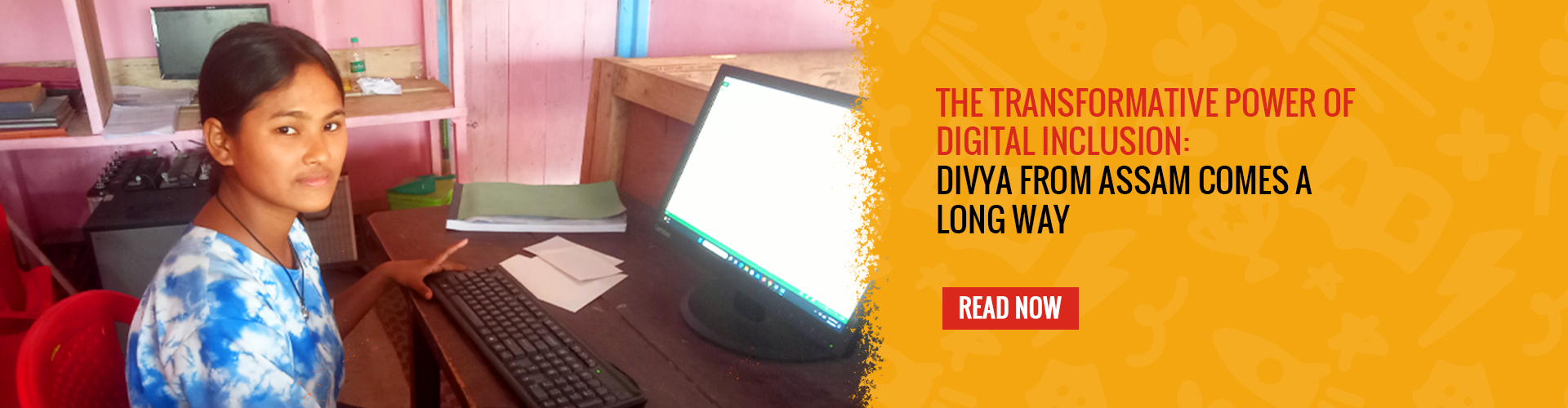

STORIES OF RAKSHA FROM THE FIELDS OF INDIA

STORIES OF RAKSHA FROM THE FIELDS OF INDIA

Empowering Women in Rural Andhra through Livelihood Skills Training

Ramadevi comes from a village called Momidi, 70 km from Nellore in Andhra Pradesh. She is one of the few women in the village who were able to secure a Bachelor’s degree. After completing her undergraduate degree, she wanted to work and help her family out. Her father is an agricultural labourer, and her mother is a homemaker. Her brother is studying at a government college in Gudur. A monthly salary meant financial independence and help for her family. But the opportunities in the village were few. Her family didn’t allow her to move to Nellore for employment. With an undergraduate degree and no employment.

ONGOING CAMPAIGNS

YOU CAN SUPPORT

Education

#ShikshaSeSashakt

Educate to Elevate

Learning Should never Stop, No Child should lag behind

Let’s help children continue their

education

Education

Making Classrooms Smarter

Helping Children

Learn the Smart Way

Technology is an enabler and we’re tapping it to help children learn better

OUR COMMITMENT TO BE THE RAKSHAKS OF CHILDREN’S FUTURE

The Invisible Problem: Hearing Children’s Voices to Find Solutions for their Issues

In April 2022, we consolidated our commitment to reach 4 million children in the coming two years. In this journey, we have been walking together with communities, government agencies, corporations and the people for whom the causes of India’s children matter. But most importantly, we are here to listen to children and build this into a movement for and with them.